Grey County Housing Market Update: Looking Ahead to 2026

Quiet End To Home Sales In 2025 – What’s In Store For 2026?

That was a bit unexpected.

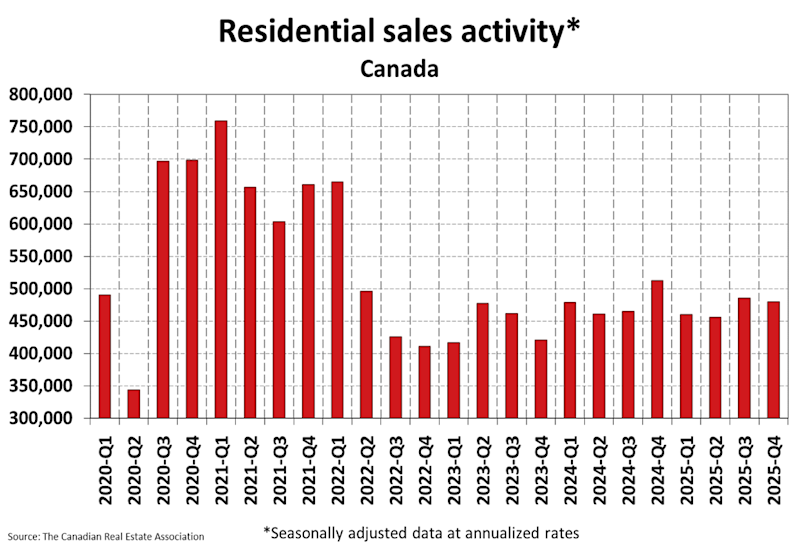

After months of increased or stable home sales numbers, transactions dipped 2.7% in December compared to November and were down 4.5% compared to a year ago, according to the latest housing data released from the Canadian Real Estate Association (CREA).

And, yes, while an uptick in home sales to end the year was previously forecasted, it doesn’t mean a flurry of activity is out of the question by the time the snow melts.

“It would be prudent for market observers to resist the temptation to trace a line from the end of 2025 into 2026,” explains CREA’s Senior Economist Shaun Cathcart. “Rather, we continue to expect sales to move higher again as we get closer to the spring, rejoining the upward trend that was observed throughout the spring, summer, and early fall of last year.”

Before we get into 2026 price and sales forecasts, here’s what you need to know about Canada’s current real estate markets:

- National home sales declined 2.7% month-over-month in December.

- The number of newly listed properties dropped 2% on a month-over-month basis.

- There were 133,495 properties listed for sale on all Canadian MLS® Systems at the end of December 2025, up 7.4% from a year earlier.

- The non-seasonally adjusted national average home price was $673,335 in December 2025, virtually unchanged (-0.1%) from December 2024.

space

Why are home sales dwindling in Canada and is that expected to continue?

The narrative hasn’t changed. Canadians had wanted lower interest rates (✅), more affordable prices (✅), and more options (✅), but uncertain economic times stemming back to last spring have had a major impact on Canada’s home buyers, especially in the country’s largest markets like Vancouver, Calgary, Edmonton and Montreal.

Look at Toronto, for example. The Toronto Regional Real Estate Board (TRREB) reports there were only 62,433 homes sold in Toronto last year, making it the lowest amount of sales since 2000.

“Reaffirmed trade relationships and large-scale domestic economic development projects will be key for improved home sales moving forward,” said TRREB Chief Information Officer Jason Mercer. “GTA households must be confident in their employment situation before committing to long-term monthly mortgage payments, even in this more affordable market.”

Canada’s second largest market, Vancouver, also reported a significant drop in home sales, reaching a level not seen in more than 20 years. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 23,800 in 2025, a 10.4% decrease from the 26,561 sales recorded in 2024.

“We had a very weak starting point (to 2025) and that’s why overall sales are down, even though the sort of rally, the upward trend we predicted did happen, it just got really slammed back by that tariff shock,” Cathcart says in the latest CREA Housing Market Report.

Cathcart suggests because everything is in place, real estate markets could turn rather quickly come spring.

“Keep in mind new supply has been down in six of the last seven months, overall supply in the market isn’t piling up, it’s been falling since May because sales have been stronger, and so we’ve got a market now that really could turn around quite quickly if you’ve got a lot of buyers coming back to the market this spring, which is in our forecast.”

space

Will homes be more affordable in 2026?

In its most recent quarterly forecast, CREA says the national average price of a home is expected to rise 2.8% compared to 2025, going from $679,543 to $698,881.

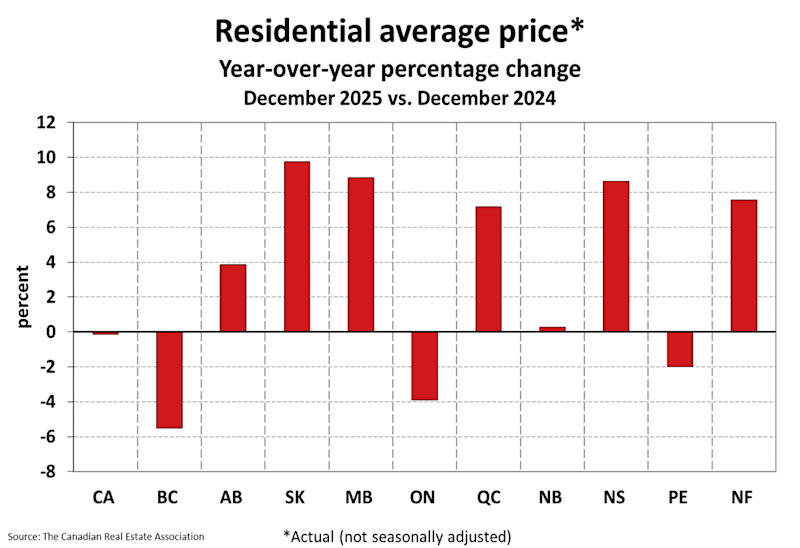

Affordability dynamics, however, continue to vary widely by region. Saskatchewan and Manitoba are set to lead growth among the prairie provinces over the next two years, thanks to their lower average prices. Quebec should also continue to stand out, with prices expected to rise steadily through 2027 as demand remains strong and affordability compares favourably with Ontario and British Columbia.

By contrast, higher-priced markets are projected to rise more gradually. Average prices dipped in Ontario and British Columbia in 2025, but both provinces are expected to see steady growth in 2026 and 2027. This more balanced pace may create opportunities for buyers focused on major urban centres but of course, your best option is to consult with a REALTOR® before making your next move.

space

“While we remain in the quiet time of year for a little while longer, the spring market is now just around the corner, and it is expected to benefit from four years of pent -up demand, and interest rates that at this point are about as good as they are going to get,” said Valérie Paquin, Chair of CREA’s 2025-2026 Board of Directors and a REALTOR® based out of Blainville, Quebec. “Barring any further major uncertainty -causing events, that means we should see a more active market this year. You can get a jump on your 2026 housing plans by contacting a local REALTOR ®.”

space