Ontario’s First-Time Buyer Rebate Explained

Hope to be buying your first home in 2025? Ontario‘s first-time buyer rebate, explained here, could save you up to $130K on a new build or significant renovation! If you’ve been dreaming of buying your first home but feeling priced out, there’s finally a bit of good news on the horizon. The Ontario government just announced a proposed HST rebate that could save first-time buyers up to $130,000 on a newly built home.

It’s not official yet — the plan will be part of the Fall Economic Statement on November 6, 2025 — but if approved, this could be a major step toward making home ownership more achievable in Ontario.

space

space

💸 What’s Being Proposed

Here’s the short version:

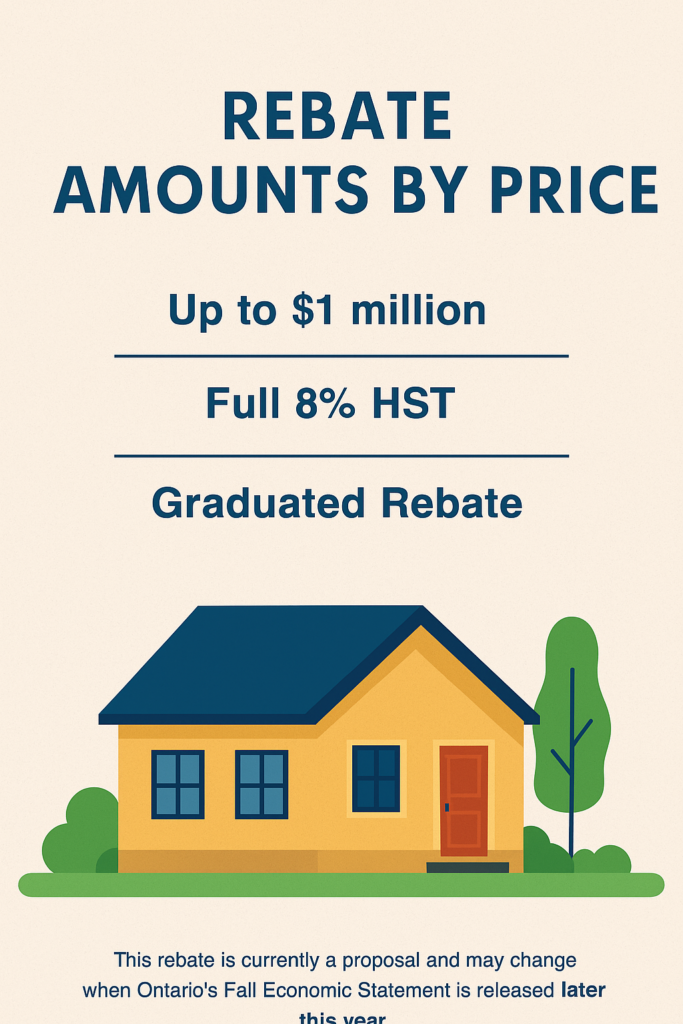

- Ontario plans to remove the 8% provincial portion of the HST on new homes up to $1 million for first-time buyers.

- The federal government has also proposed removing the 5% GST.

- Together, that could mean up to $130,000 in total savings if both plans are approved.

Example: On a $1 million new home, that’s the full 13% HST off the purchase price — a serious win for new buyers!

space

Ontario’s First-Time Buyer Rebate Explained

space

🏠 Who Qualifies

If this rebate gets approved, here’s who could take advantage:

- First-time buyers (you can’t have owned a home before)

- Buying a newly built or substantially renovated home

- Home price up to $1 million for the full rebate (partial savings up to $1.5M)

- The home must be your primary residence

- Purchase agreements signed on or after May 27, 2025

space

space

⚙️ How It Works

If you qualify, your builder or lawyer would usually apply the rebate at closing — meaning you’d see the savings right away instead of waiting for a refund later.

Ontario’s First-Time Buyer Rebate Explained

space

💰 Stack Your Savings

Even better, this proposed rebate can be combined with existing first-time buyer programs:

- First Home Savings Account (FHSA): Save up to $40,000 tax-free

- Home Buyers’ Plan (HBP): Withdraw up to $60,000 from your RRSP

- Land Transfer Tax Rebates: Up to $8,475 if you’re buying in Toronto

- First-Time Home Buyers’ Tax Credit: Worth $1,500

- 30-year amortization: Now available for new builds, lowering monthly payments

space

space

📉 Why This Matters

Let’s be honest — buying your first home in Ontario has never been tougher. With average prices around $1.1 million in the GTA and still high across most of the province, every bit of help counts.

This rebate could make new homes more affordable, encourage new construction, and give first-time buyers a much-needed boost toward home ownership.

space

Ontario’s First-Time Buyer Rebate Explained

space

🗓️ The Bottom Line

If approved, the new Ontario HST rebate could:

As of the date this blog was published, the First Time Buyer Rebate is still a proposal — but it’s one worth watching closely.

space

space

🏠 Thinking About Buying Your First Home?

Even if this rebate is still in the works, there are already several programs that can help make your first purchase more affordable. If you’d like to understand your options or run the numbers for your situation, let’s chat — we would be happy to help you plan your path to homeownership.

space

Note: The information in this post is meant to help you stay informed, but it’s not legal advice.

Before making any real estate or financial decisions, it’s always best to check with a qualified professional.